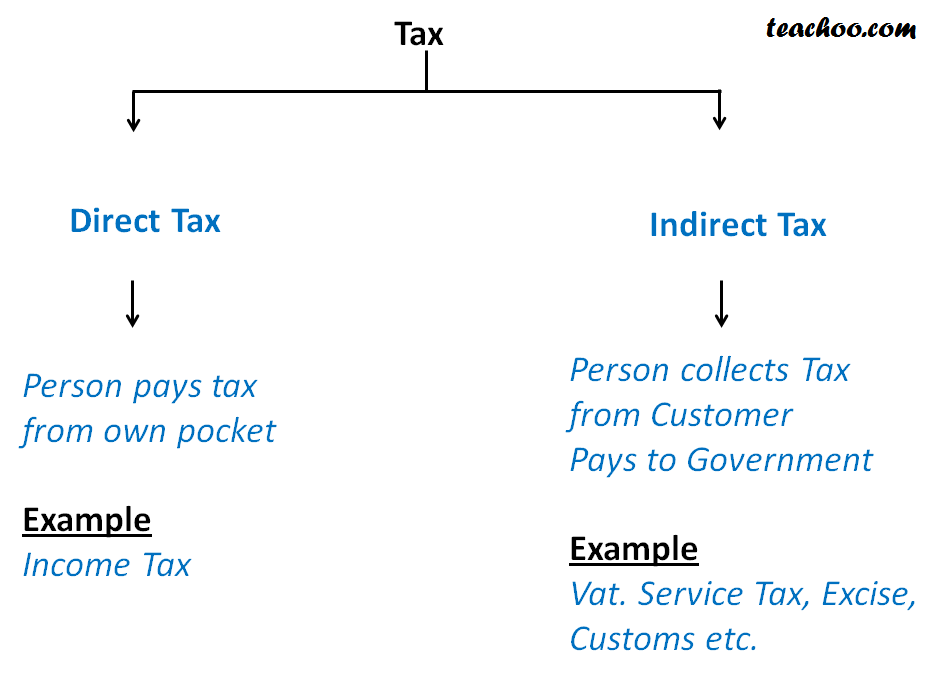

If you need software to guide you through basic tax preparation, HR Block is here to help. Download our basic tax filing software and finish your taxes today. Fast forward 25 years: Joe is an Enrolled Agent with a MS in taxation, while Daina has started finished a 16 year career as an ICU RN and has joined him in the office as a preparer and website geek. Learn advanced taxation online. This nationally accredited course provides knowledge that will help you with the IRS Enrolled Agent exam. Allan Sheahen is the author of Guaranteed Income: The Right to Economic Security, which was published in 1983. In 2005, Sheahen coauthored, with Karl Widerquist, The Tax Cut for the Rest of Us Act, the first true guaranteed income bill ever introduced in the U. Get the IRS off your back and out of your Life Forever. Let Irwin Schiff show you how you can Legally Stop Paying Income Taxes. We are getting to the deep end of income tax season and there is virtually no time to procrastinate filing. Here is a complete guide to help you get it right from start to end. As AI and automation eliminate jobs, some of tech's biggest names are rallying behind 'universal basic income. On final tax amount, a surcharge of 3 No surcharge above 10 lacs. An additional surcharge of 15 will be applicable on persons whose annual income is above Rs. Taxation Reviewer Free download as PDF File (. taxation notes, reviewer The First Online Income Tax Course With Fully Integrated Tax Preparation Training! Our online income tax course is the only income tax course available that is fully integrated with a professional tax software program, the 1040 ValuePak. The federal income tax is one of the most complicated innovations in human history. But were going to try and simplify the whole enchilada with this handy federal income tax guide. This notice describes how existing general tax principles apply to transactions using virtual currency. The notice provides this guidance in the form of answers. The extra tax that you will pay at 20 because of having 235 fewer personal allowances will collect the 47 unpaid tax (235 x 20 47). If HMRC reduced your personal allowance by 47, then you would only pay additional tax of 9. Income tax: Income tax, levy imposed on individuals (or family units) and corporations. Individual income tax is computed on the basis of income received. It is usually classified as a direct tax because the burden is presumably on the individuals who pay it. Student Income Tax Return Guide. Important: Starting with Tax Year 2018 (Jan. 2018), student related education tax credits, deductions, and savings plans are changing due to recent Tax Reform. We are updating this page as the facts become available. com help you and become eligible to Tax Win. WASHINGTON, DC Universal basic income (UBI) schemes are getting a lot of attention these days. Of course, the idea to provide all legal residents of a country a standard sum of cash unconnected to work is not new. HR Block Basic Tax Software 2017 Refund Bonus Offer Simple Tax Solutions The right choice for customers with simple tax situations. Although the people conducting the study call it a basic income, it is a negative income tax that is conditional not only on household income, but also on household size. Calculating personal income tax in Malaysia does not need to be a hassle especially if its done right. Read on to learn all you need to know about filing your 2018 personal income tax. The Income Tax Course is offered with no charge for tuition or course fees. Students are required to purchase course materials in all states except for New York and Tennessee, where purchase of some materials are optional. When Did Income Tax Start In Australia? Income Tax was first introduced into Australia in 1915 in a bid to fund the First World War. Legislatively, the Taxation Administration Act 1953 was assented to on March 4 1953..